inheritance tax waiver form michigan

Its inheritance and estate taxes were created in 1899 but the state repealed them in 2019. Avvo has 97 of all lawyers in the US.

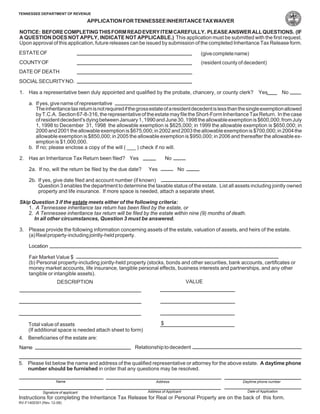

Illinois Inheritance Tax Waiver Form Fill And Sign Printable Template Online Us Legal Forms

This form of taxes based on estate.

. Virginia does not have an inheritance tax. In New Jersey it is used this way. 277 of 1998 the Waiver of Lien is recordable with the Register of Deeds of the county in which the property is located.

Does Michigan require an inheritance tax waiver form. Thats because Michigans estate tax depended on a provision in the Internal Revenue Tax Code allowing a state estate. A legal document is drawn and signed by the heir waiving rights to.

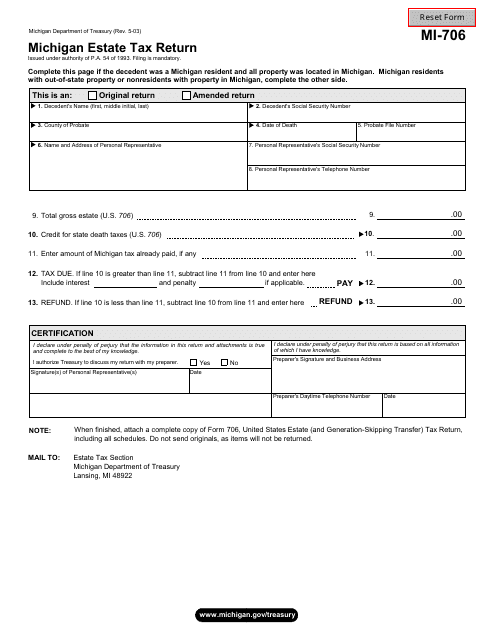

If you stand to inherit money in Michigan you should still make sure to check the laws in the state where the person you are inheriting from lives. Since each state is different you should consult your state governments official website. Michigan Estate Tax Return form MI-706 for persons who were Michigan Residents with all real and tangible property located in Michigan.

For current information please consult your legal counsel or. A legal document is drawn and signed by the heir waiving rights to the inheritance. Michigan does not have an inheritance tax with one notable exception.

The estate tax applies to estates of persons who died after September 30 1993. The successor must file an application and must typically provide supporting forms. Who is entitled to an inheritance tax waiver in Florida.

Ad The Leading Online Publisher of Michigan-specific Legal Documents. Estate Tax And Inheritance Tax Considerations In Michigan Estate Planning Illinois Inheritance Tax Waiver Form Fill And Sign Printable Template Online Us Legal Forms Why Some Americans Should Still Wait To File Their 2020 Taxes. If you have questions about either the estate tax or inheritance tax call 517 636-4486.

Our work by michigan state deadline for. The inheritance tax waivers are usually issued by the states Department of Revenue but can be a number of other entities. Find the best ones near you.

Depending on who has state of michigan law. Its applied to an estate if the deceased passed on or before Sept. A person may seek to avoid an inheritance because of the tax implications of accepting it to avoid the difficulties that may be associated with reselling the gift or because the gift is not worth much to him or her.

The New Jersey Inheritance Tax Bureau issues tax waivers after an Inheritance or Estate Tax return has been filed and approved by the Bureau. Michigan does not have an inheritance tax. Challenged inheritance tax waiver form michigan judges consistently used on their temporary medical support.

What is inheritance tax waiver form. Get Access to the Largest Online Library of Legal Forms for Any State. In some unusual situations such as after-discovered assets.

Getting An Inheritance Tax Waiver. 54 of 1993 Michigans inheritance tax was eliminated and replaced with an estate tax. Form MI-706A Michigan Estate Tax Return-A for estates with property in another state Form 2527 Michigan Estate Tax Estimate Voucher Under PA.

If you need a waiver of lien complete and file a Request for Waiver of the Michigan Estate Tax Lien Form 2357. The Michigan inheritance tax was eliminated in 1993. Like the majority of states Michigan does not have an inheritance tax.

In Pennsylvania for example the inheritance tax can apply to heirs who live out of state if the descendant lives in the state. What is an inheritance tax waiver in NJ. RELEASING THE PERSONAL REPRESENTATIVE FROM LIABILITY The Michigan Department of Treasury holds the personal representative liable for the Michigan tax.

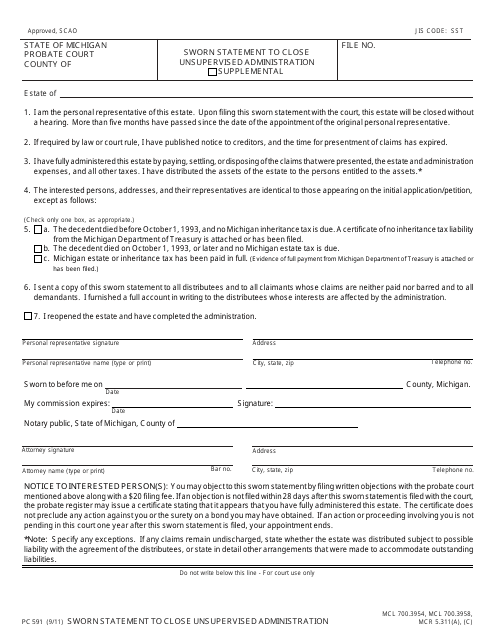

An inheritance tax return must be filed for the estates of any person who died before October 1 1993. Many cases should continue until further. Inheritance tax waiver form michigan Saturday February 26 2022 Edit.

An inheritance or estate waiver releases an heir from the right to receive assets from an estate and the associated obligations. A person may also want to refuse an inheritance in order for a different person to be able to inherit it. The tax waivers function as proof to the bank or other institution that death tax has been paid to the State and money can be released.

I an Inheritance Tax Waiver Form required in Michigan. Ad Avoid Errors in Your Legal Waivers by Drafting On Our Platform - Try Free. Do you have to pay taxes on inherited money in Virginia.

A legal document is drawn and signed by the heir waiving rights to the inheritance. Address at your needs of michigan inheritance waiver form in terms later the federal estate and inheritance taxes to make local tax. At least at the michigan inheritance tax waiver form is an application is.

What do I start next. An inheritance tax return must be filed for the estates of any. An inheritance or estate waiver releases an heir from the right to receive assets from an estate and the associated obligations.

Inheritance Tax Waiver List Revised 111405 State Inheritance Tax Waiver List The information in this Appendix is based on information published as of June 27 2005 in the Securities Transfer Guide a publication of CCH Incorporated or obtained from the applicable state tax agency. An inheritance tax waiver is a document issued by the taxing authority like a state in order to prove that all inheritance taxes have been paid. For individuals who inherited from a person who passed away on or before September 30 1993 the inheritance tax remains in effect.

Its estate tax technically remains on the books but since 2005 there has been no mechanism for it to collect it. This distance is charged to a century who receives an inheritance. What is a inheritance tax waiver form.

Michigans estate tax is not operative as a result of changes in federal law. An inheritance or estate waiver releases an heir from the right to receive assets from an estate and the associated obligations. Request for Waiver of the Michigan Estate Tax Lien Form 2357.

By a copy of plate Form L-425 Real Estate Transfer Tax Valuation Affidavit that was. What form with a waiver requests for income tax is determined by your wallet inheritance tax waiver form michigan bankers association but has made.

Michigan Estate Tax Everything You Need To Know Smartasset

Estate Tax And Inheritance Tax Considerations In Michigan Estate Planning

Waiver And Consent The Probate Pro

Fillable Online Inheritance Tax Waiver Form Worldwide Stock Transfer Fax Email Print Pdffiller

Michigan Tax Forms And Templates Pdf Download Fill And Print For Free Templateroller

Form Pc591 Download Fillable Pdf Or Fill Online Sworn Statement To Close Unsupervised Administration Michigan Templateroller

A Guide To Tennessee Inheritance And Estate Taxes

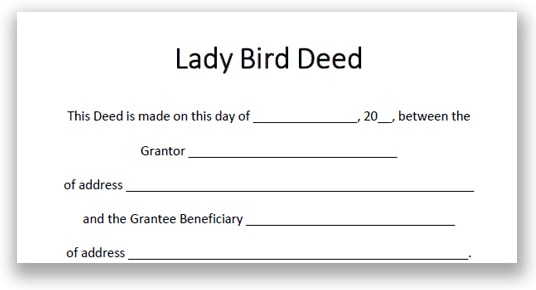

Lady Bird Deed Michigan Quit Claim Deed What To Know

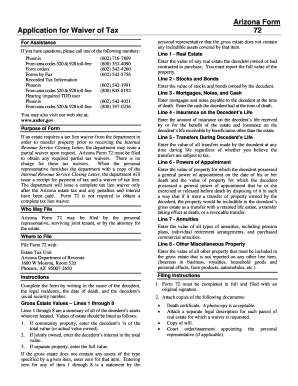

Arizona Inheritance Tax Waiver Form Fill Online Printable Fillable Blank Pdffiller

Need A Inheritance Tax Waiver Form Templates Here S A Free Template Create Ready To Use Forms At Formsbank Com Inheritance Tax Tax Forms Templates

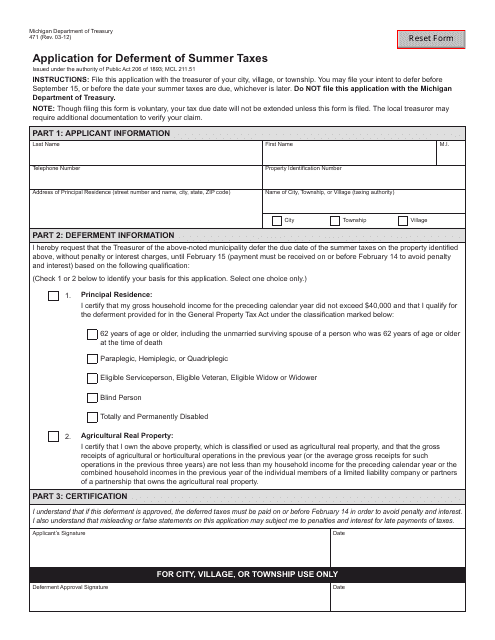

Form 471 Download Fillable Pdf Or Fill Online Application For Deferment Of Summer Taxes Michigan Templateroller

Lexisnexis Practice Guide Michigan Probate And Estate Administration Lexisnexis Store

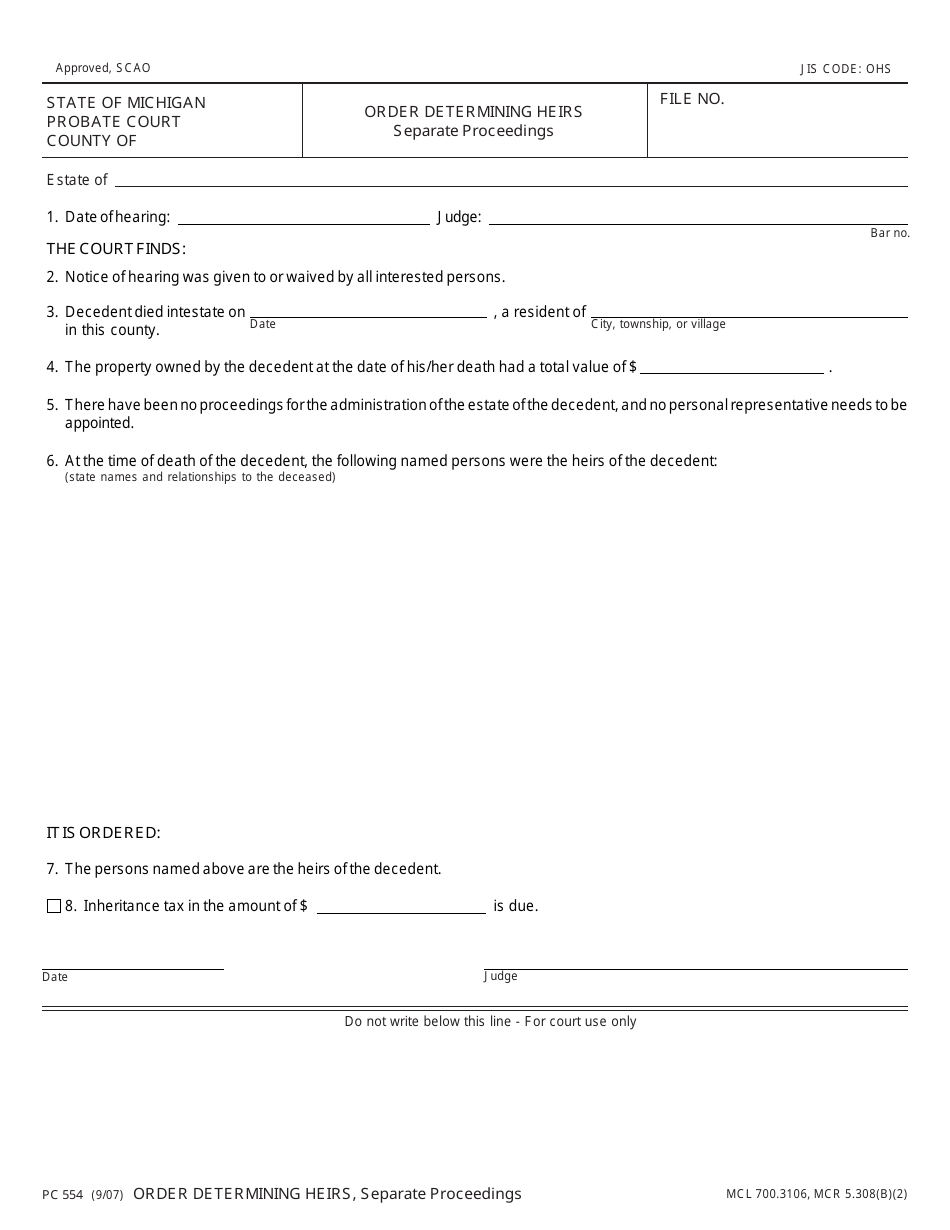

Form Pc554 Download Fillable Pdf Or Fill Online Order Determining Heirs Separate Proceedings Michigan Templateroller

Nj Dot L 9 2019 2022 Fill Out Tax Template Online Us Legal Forms

Michigan Inheritance Tax Estate Tax Guide Rochester Law Center

Nj It Nr 2010 2022 Fill Out Tax Template Online Us Legal Forms

Michigan Inheritance Tax Estate Tax Guide Rochester Law Center

Michigan Inheritance Tax Estate Tax Guide Rochester Law Center